Li Lu #1: The Early Bets That Built a Legend

From Russian oil to Korean pricing power — what his first investments teach us about value, risk, and clarity

What can we learn from Li Lu’s early investments?

I’ve gathered study material and clips covering some of his most striking bets — from Russian oil vouchers to overlooked Korean cosmetics. These aren’t just case studies in deep value investing — they’re masterclasses in independent thinking, research intensity, and knowing where to fish.

Here's a quick list of the investments covered below:

Lukoil (1994–1995) – Russian Voucher Privatization

American Tower (1990–1996) – ??? (more research needed)

Timberland (1998) – During the Asian Financial Crisis

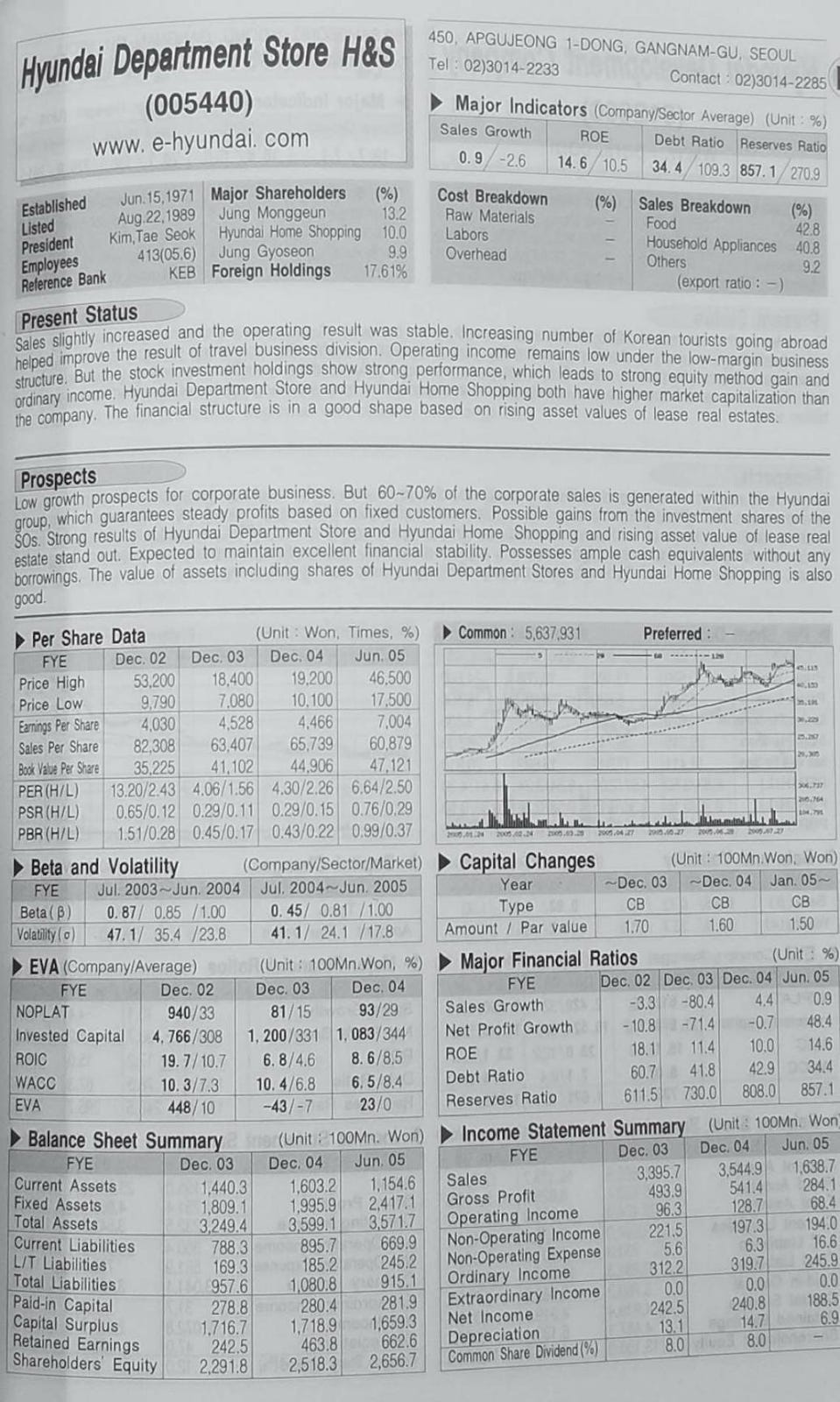

Hyundai Department Store (2004) – Ripple effects from the crisis

Megastudy & Amorepacific (2004–2012) – See lecture notes below

Ottogi (?) – Korean sauce monopoly with hidden pricing power

Bonus: Buffett had a personal portfolio of 20 Korean stocks around 2004 — clearly, the fishing was good.

Lukoil (1994–1995): The One-Hundred-Bagger That Took Guts

One thing becomes clear when you study Li Lu: he’s willing to go the distance — literally. For Lukoil, he traveled to Russia during the post-Soviet voucher privatization era. Oil companies were effectively being given away: you could buy into them at half a cent to a cent on the dollar.

Even after the 1998 ruble devaluation wiped out 90% of the currency’s value, early investors still made 10x returns. In nominal terms? A one-hundred-bagger.

📚 Read up on Russian Voucher Privatization

🎥 Watch the clip about Lukoil below:

Timberland (1998): Lawsuits, Legwork, and a 6–8x Return in 2 Years

Li Lu found Timberland the old-school way — flipping through company manuals A to Z. It looked cheap, but there was a cloud of shareholder lawsuits hanging over management. Most people would’ve passed.

Instead, he dug in. He read everything, even flew out to meet management. Two years later, the stock had gone up 6–8x.

And the kicker? He says the whole process took him just a couple of weeks.

Some investors spend months on “due diligence” and still don’t get it. Others rush in after an hour of reading. Li Lu’s story is a reminder: time isn’t the point — understanding is.

📚 Read up on the Asian Financial Crisis

📄 See the student manual page:

🎥 Watch the clip here:

Hyundai Department Store (2004): A 6-Bagger in 2 Years

In the lecture clip, Li Lu gets visibly frustrated — the students hadn’t done their homework. Can you blame him? He’s standing there offering gold, and they didn’t bother to bring a pan.

Hyundai Department Store was cheap both on an asset and earnings basis. He saw it — and in the following two years, the stock went up around 6x.

📄 See the manual page:

🎥 Watch the clip here:

Megastudy & Amorepacific: Cheap Meets Quality

These two investments, covered in the CBS lecture notes, are textbook examples of the value investor’s holy grail: great businesses at bargain prices.

Each had its own quirks — but both were clearly mispriced. If you can find something like this, you don’t just get a good outcome — you win big.

📄 Read the CBS lecture notes here

Ottogi

We know that Munger said Li Lu bought Ottogi:

And knowing that, of course, one of the tricks is knowing where to fish. Li Lu [of Himalaya Capital Management LLC in Seattle] has made an absolute fortune as an investor using Graham’s training to look for deeper values. But if he had done it any place other than China and Korea, his record wouldn’t be as good. He fished where the fish were. There were a lot of wonderful, strong companies at very cheap prices over there.

Let me give you an example. One guy in Korea, he cornered the sauce market. And when I say cornered, he had like 95% of all the sauce in Korea. And he couldn’t stand anybody else ever selling any sauce. So he could have made two or three times as much if he wanted to by raising the prices.

Li Lu figured that out. It’s called Ottogi. And of course we’ve made 20 for 1. There was nothing like that in the United States.

📖 Source: Charlie Munger, Unplugged - WSJ, 2019

I haven’t found more detailed information on this investment yet, but it’s a striking example of what happens when you find a dominant business, priced cheaply, in a market few others are looking at.

These case studies are worth your time. If you’re not already familiar with them, I highly recommend digging in — they’re incredibly instructive for any serious investor.

I may post my own valuations and notes on these in future installments of a Li Lu series.

If you’re interested in deep value, real-world examples, and the mental models behind great returns — Subscribe to follow along.

This was deeply informative, more posts please!

What did you think about this post? Do you want to find out more about Li Lu's investments?

Feel free to give me feedback and comment. I am still learning.